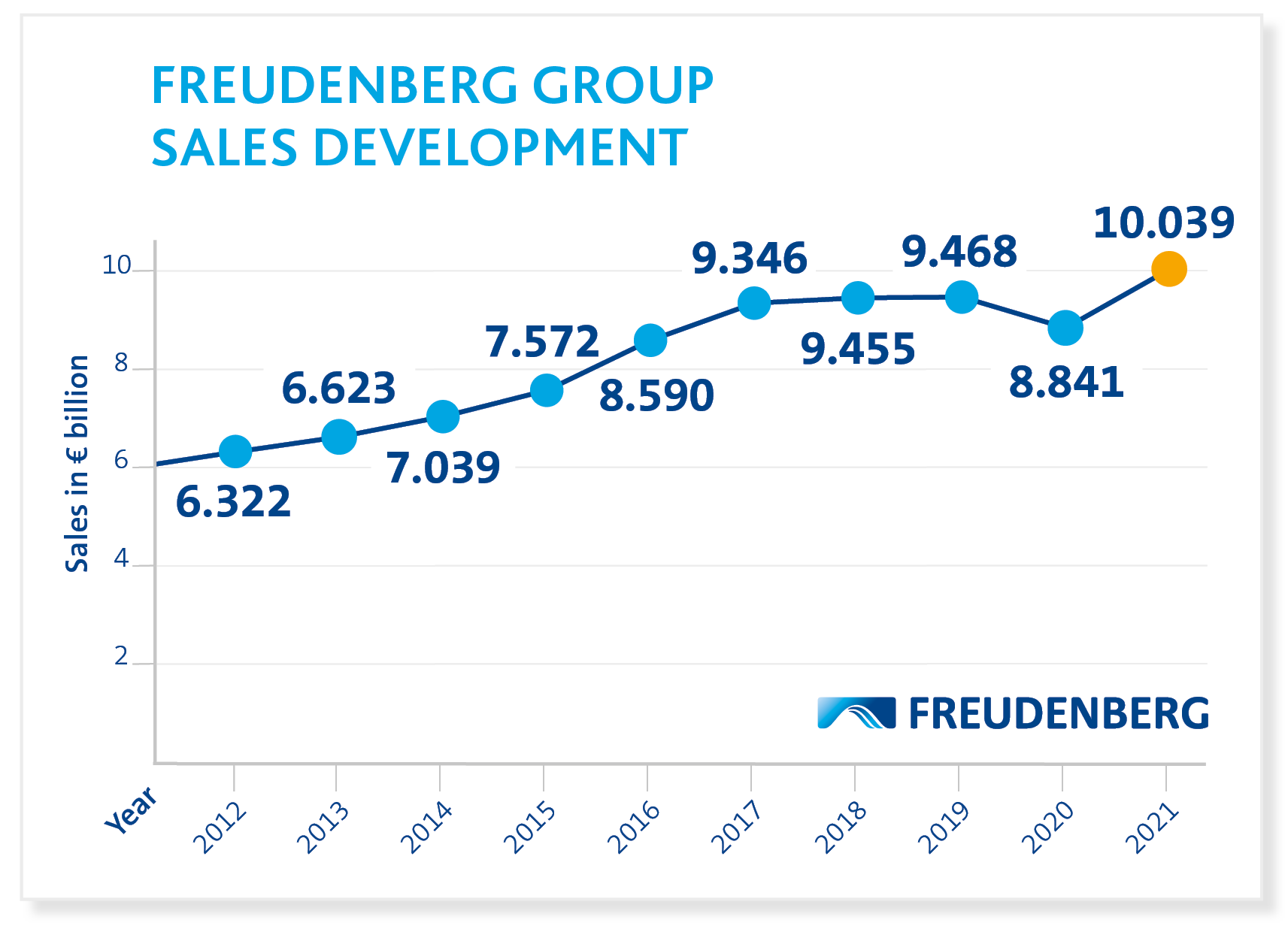

- Record sales above €10 billion (plus 14 percent)

- Operating profit of €877 million (plus 31 percent)

- Battery and fuel cell business as independent Business Group

- Progress in Sustainability – Freudenberg climate-neutral by 2045

Weinheim, March 30, 2022. The Freudenberg technology group can look back on a successful year. Sales and profit increased significantly in the past 2021 financial year. “It was a strong and very successful year for Freudenberg. For the first time, sales exceeded the €10 billion mark,” said Dr. Mohsen Sohi, CEO of the Weinheim-based Freudenberg Group, commenting on the results. At €10,038.7 million, sales were significantly above the previous year’s figure of €8,840.8 million. Furthermore, Freudenberg reported a profit from operations of €877.3 million, also considerably higher than the figure of €669.9 million for 2020. “Thanks to our entrepreneurial success, we continue to invest in machinery, equipment and future-oriented technologies at a high level. The battery and fuel cell business is being grouped together in a separate Freudenberg Battery & Fuel Cell Business Group. The change takes effect April 1,” Sohi added.

The Freudenberg Group is following the tragic events in Ukraine with grave concern: “Freudenberg is committed to an open, free Europe and peaceful coexistence worldwide. Our thoughts are with the people affected by the war. To support them, Freudenberg is donating €3 million as immediate humanitarian aid. €1 million has already been paid out and is split equally between Doctors without Borders, Save the Children, Aktion Deutschland hilft and Aktionsbündnis Katastrophenhilfe,” Sohi said. The company's employees and partners also donated a further €560,000.

Sustainability: a climate-neutral company by 2045

By 2045, Freudenberg intends to become a climate-neutral company. An initial target is to achieve a 25 percent reduction in specific CO2 emissions per million euros of sales by 2025 compared with 2020. With this aim in mind, the company is pursuing a strategy based on energy-saving, electrification, the purchase and generation of green power, and the offsetting of CO2 emissions. Last year, these efforts focused on two objectives: electrifying energy demand and obtaining all required electricity from renewable sources such as wind, solar and hydroelectric power.

One example is the Power Purchase Agreement covering the supply of solar electricity from Tramm-Göthen, where Germany's largest photovoltaic park to date has been built. On an area equivalent to 347 football fields, 420,000 solar modules generate about 172 megawatts of electricity annually. The financing of this megaproject was facilitated by a purchase contract for all of its green electricity over a period of ten years. The agreement was concluded by Freudenberg and automaker Volkswagen on one hand and the electricity provider RWE on the other.

Financial figures in detail

At €10,038.7 million, total sales were considerably above the level for 2020 (previous year: €8,840.8 million). This figure includes negative currency effects amounting to €94.9 million. These chiefly result from trends in the exchange rates of the US dollar, the Turkish lira and the Japanese yen. Acquisitions contributed about €193.3 million to sales in the year under review, while disinvestment effects amounted to about €25.4 million.

On the basis of business developments, the Group generated profit from operations of €877.3 million, considerably higher than the prior-year figure of €669.9 million. This corresponds to a return on sales of 8.7 percent. The main driver of growth was higher sales; significantly higher material prices had a negative impact.

At €861,8 million, cash flow was below the figure of €1,138.8 million for the previous year. The reasons included the considerable increase in working capital. The equity ratio has slightly increased to 50.2 percent (previous year: 48.0 percent).

The international rating agency Moody’s Deutschland GmbH confirmed a credit rating of A3 for Freudenberg, with a stable outlook. The Group therefore continues to hold an excellent single A rating.